cryptocurrency tax calculator free

Try It Yourself Today. The programme applies the same calculation principles as the tax authorities so you do not have to worry about how to calculate taxes on staking or whether you report your profits and losses as a net.

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

To help you with your tax planning for tax year 2021 you can also find out if you have a capital gain or.

. See our 500 reviews on. Select the appropriate tax year. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on the ATO website and does not constitute.

ATO ready tax reports. Repeat for all Bitcoin or cryptocurrency sales within the tax year selected. Valid from 1126 to 1130.

You can discuss tax scenarios with your accountant. Simply The 1 Tax Preparation Software. There are cloud-hosting tools specifically designed for crypto miners.

When your data is imported Kryptax automatically calculates your profits and losses on cryptocurrency. The Taxes Owed are. The popularity of cryptocurrencyBitcoin investments continues to skyrocket.

For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms. Make sure the sale date is within the tax year selected.

Blox free Pro plan costs 50K AUM and covers 100 transactions. If they hold onto their coins for at least a year they can benefit from lower long-term capital gains taxes which range. Because of this long-term crypto investors have a valuable opportunity.

Get Started for Free. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. This is a free simple and easy to use cryptocurrency tax calculator.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. This is a simplified calculator to help you calculate the gains of your cryptocurrency. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year.

Enter your income for the year. Input your state tax rate. 0325 5000 1625.

Enter the purchase date and purchase price. Free Crypto Tax Calculator for 2021 2022. Supports DeFi DEX trading.

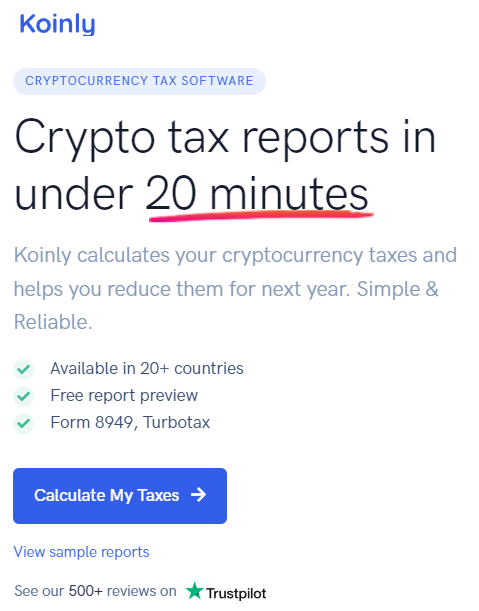

Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. The tax rate on this particular bracket is 325. Some of such advantages are mentioned below.

Enter the cryptos purchase. Under Add A Sale. However even though interest in cryptocurrencies continues to expand and the IRS has.

The business plan comes at 99 per month and covers 10K taxations and 20 million in assets. Available in 20 countries. Enter the sale date and sale price.

STEP 2 KRYPTAX CALCULATES YOUR TAX. According to a May 2021 poll 51 of Americans who possess cryptocurrencies did so for the first time in the previous 12 months. You can use this calculator to get a quick estimate of the taxes you may owe in 2021 on your cryptocurrency gains.

Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. Use code BFCM25 for 25 off on your purchase. The purchase date can be any time up to December 31st of the tax year selected.

Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly. The Result is. The best way to choose them and save on your taxes is to use a free crypto tax calculator like ZenLedger.

Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give you an estimate of how much your sales will be taxed and much more. With our bitcoin tax reporting. You simply import all your transaction history and export your report.

The cryptocurrency tax calculator provides a 100 accurate answer every time removing any possibility of human error. Choose your tax status. Janes estimated capital gains tax on her crypto asset sale is 1625.

There are many benefits of using a cryptocurrency tax calculator. This will often be the same as your adjusted gross income AGI. Enter your taxable income minus any profit from crypto sales.

Blox supports the majority of the crypto coins and guides you through your taxation process. In this article we go over the main features of a cryptocurrency tax calculator. Using this calculator you can.

Choose how long you have owned this crypto. Choose your tax filing status. Derive your estimated gain or loss Determine the estimated capital gains taxes.

What are the benefits of Fisdom cryptocurrency tax calculator.

Crypto Tax Calculator Cryptotaxhq Twitter

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software Top Solutions For 2022

Coinpanda Free Bitcoin Crypto Tax Software

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software Top Solutions For 2022

Cryptocurrency Tax Calculator Forbes Advisor

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Coinpanda Free Bitcoin Crypto Tax Software

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

![]()

Cointracking Crypto Tax Calculator

Cryptocurrency Tax Guides Help Koinly

Cryptoreports Google Workspace Marketplace