ri tax rate income

The Rhode Island Income Tax Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets. DO NOT use to figure your Rhode Island tax.

Sales Tax On Grocery Items Taxjar

Instead if your taxable income.

. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. Rhode Island Tax Table. Rhode Island also has a 700 percent corporate income tax rate.

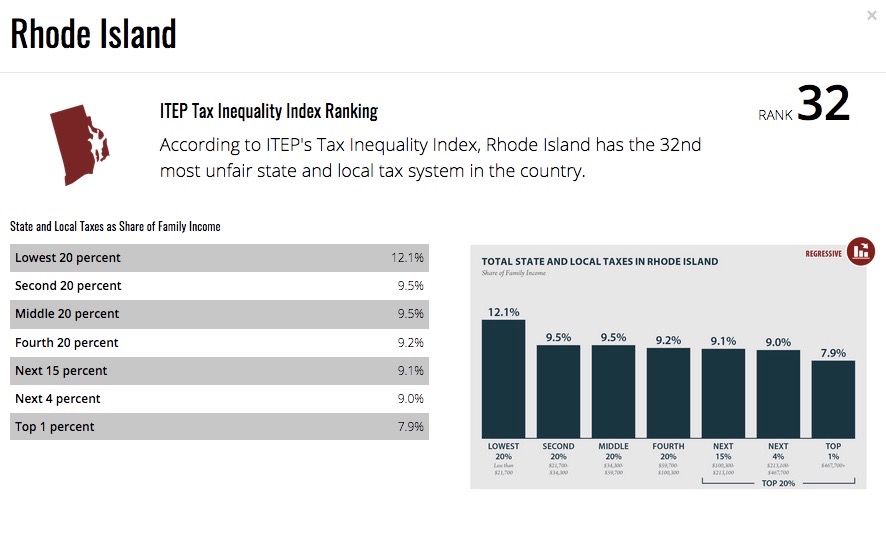

These income tax brackets and rates apply to Rhode Island taxable income earned January 1. Rhode Island - in 2018 RI was ranked 38th and in 2022 it was ranked 40th 43. For married taxpayers living and working in the state of Rhode Island.

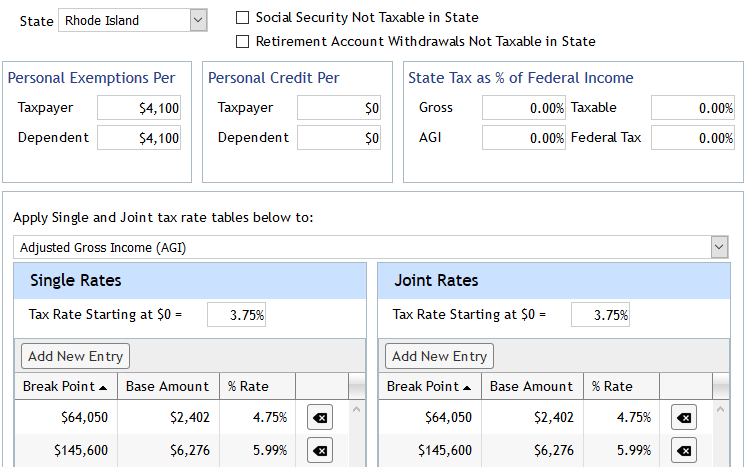

Interest on overpayments for the. Rhode Island income tax rate. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income.

Personal Income Tax A personal income tax is imposed for each taxable year which is the same as the taxable year for federal income tax purposes on the Rhode Island. DO NOT use to figure your Rhode Island tax. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

2022 Child Tax Rebate Program In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per. Enter your financial details to. The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum.

The rate so set will be in effect for the calendar year 2019. Our Rhode Island retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. Tax rate of 475 on taxable income between.

DO NOT use to figure your Rhode Island tax. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. The range where your annual income.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Tax rate of 375 on the first 68200 of taxable income. The Rhode Island State Tax Tables below are a snapshot of the tax rates and thresholds in Rhode Island they are not an exhaustive list of all tax laws rates and legislation for the full list of tax.

Unlike the Federal Income Tax Rhode Islands state. Rhode Island Tax Table. To calculate the Rhode Island taxable income the statute starts with Federal taxable income.

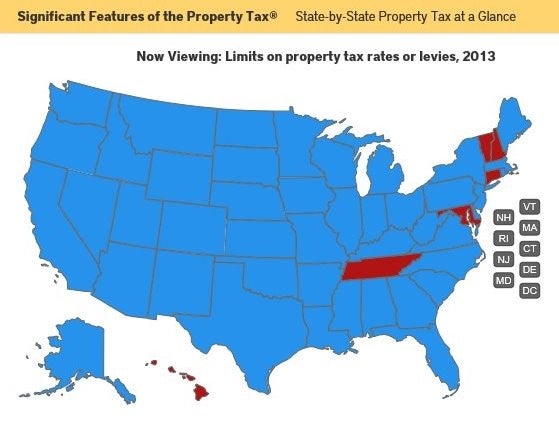

Each tax bracket corresponds to an income range. The average effective property tax rate in Rhode Island is the 10th-highest in the country though. In 2011 Rhode Islands tax system underwent the most sweeping changes since the state tax was enacted in 1971.

Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599. Any income over 150550 would be taxes at the highest rate of 599. Personal income tax.

Rhode Island Income Tax Calculator 2021 If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. And has one of the highest-rate individual income taxes. How Your Rhode Island Paycheck.

Rhode Island has a. Most notable was the reduction of. Census Bureau Number of cities that have local income taxes.

Your average tax rate is 1198 and your. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. The Rhode Island Single filing status tax brackets are shown in the table below.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. The state does tax Social Security benefits.

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

Rhode Island State Tax Tables 2021 Us Icalculator

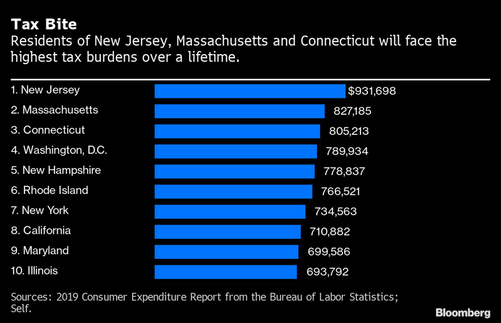

Golocalprov Ri Has The 5th Highest Tax Burden In U S

States With The Highest Lowest Tax Rates

New Jersey Taxes Newjerseyalmanac Com

Rhode Island Income Tax Brackets 2020

Which States Pay The Highest Income Tax Washington Examiner

Nris Returning To India Here Is All You Need To Know G P K Tax Consultants

Rhodeislandtax Rhodeislandtax Twitter

Rhode Island State Economic Profile Rich States Poor States

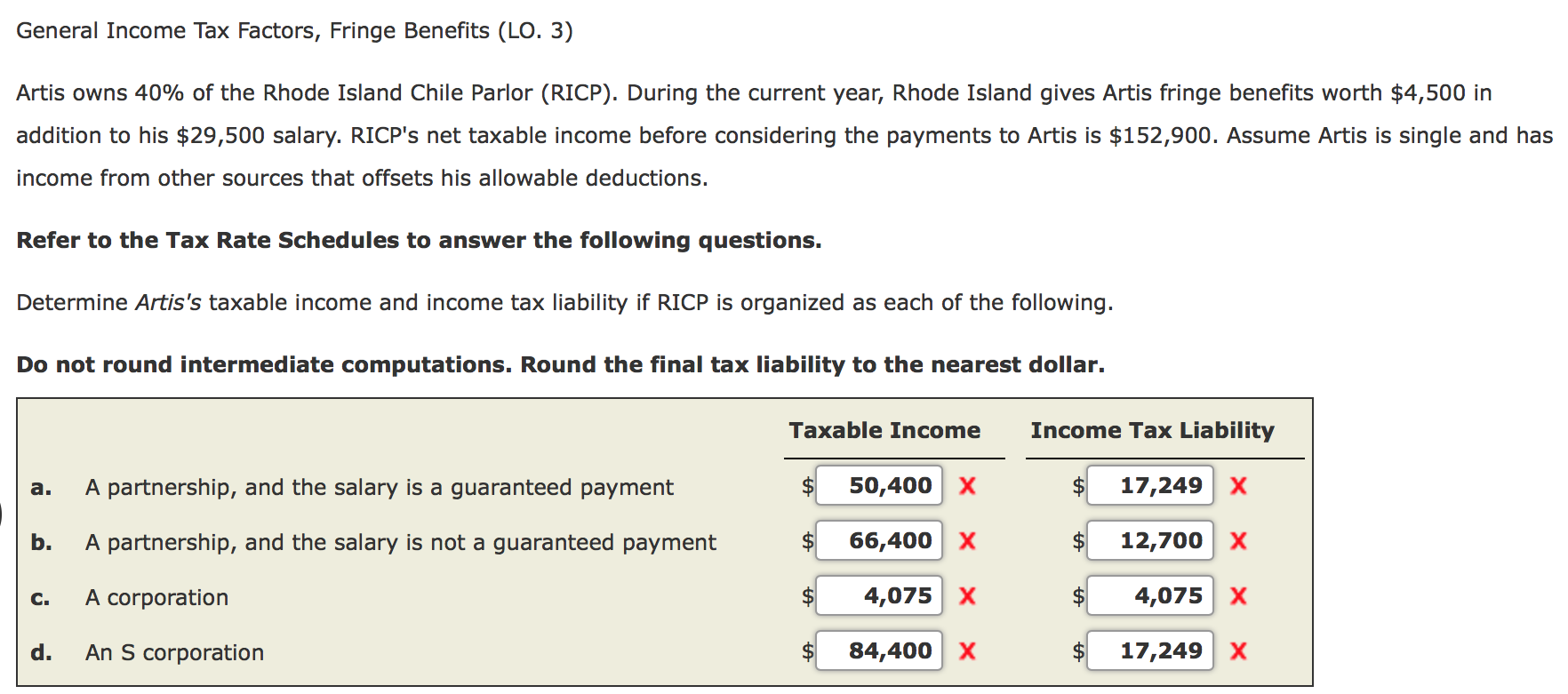

General Income Tax Factors Fringe Benefits Lo 3 Chegg Com

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

New Online Resource State By State Property Tax At A Glance Lincoln Institute Of Land Policy

Progressive Charlestown Ri What Went Wrong Tax Cuts For The Affluent

Individual Income Tax Structures In Selected States The Civic Federation

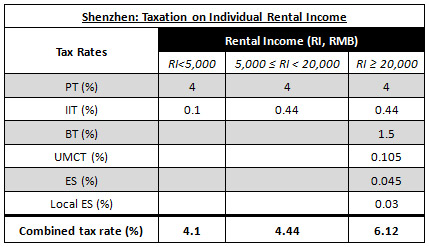

Taxation On Real Estate Rental Income In China China Briefing News